Situations encountered on the road can be interpreted by different road users in different ways. Such disputes, especially if material damage was caused as a result of the incident, can last more than one month, making it clear who is to blame. For a quick solution to such problems, insurance is applied.

In Russia, there are several types of car insurance. In the article we will decipher the hull insurance and OSAGO, what is the difference between them, also explain, and who will benefit if the car is damaged.

Content

- 1 What is OSAGO

- 2 What is hull

- 3 Difference between CASCO and OSAGO

- 4 Insured event payouts

- 5 Deadlines for reimbursement from the insurance company

What is OSAGO

The document that the traffic police officers require from drivers, except for a driver's license, is an insurance policy. This is proof of annual insurance. OSAGO stands for Compulsory third party liability insurance. With the driver, there can be different situations in which his vehicle damages any other people's property. For example, a wheel that has flown away will roll into a shop window or in a parking lot when an unsuccessful maneuver can be hooked on someone else's car.

In such situations, the insurance company will undertake to pay damages. However, you need to know that compensation will be received not by the perpetrator, but by the injured party. Payment will occur at the expense of the insurance companyconcluding a CTP agreement with the car owner. Your vehicle will have to be repaired by itself, it does not fall into the list of compensation for damage.

Before finding out how the CTPL differs from CASCO, consider three types of compulsory insurance policies:

- The document indicated specific vehicle (TC), which can be controlled by any driver, with an open category for such vehicles;

- The document indicates specific driverwhich has a certificate with the right to control such vehicles, and any vehicle of this category.

- The document indicated specific vehicle и limited list of personsapproved for management of the vehicle.

CTP policies have differences in cost. Their price depends on the region in which the registration is carried out, the time period for which the insurance contract is made, the parameters of the engine, as well as the number of owners of the car.

Note: There is a good opportunity to evaluate the benefits of voluntary auto insurance. If you are an experienced and tidy driver without an accident on an OSAGO, then when you purchase a CASCO policy from INTACH Insurance, you can get an additional benefit for a trouble-free driving on an OSAGO and save up to 19%.

What is hull

Insurance denoted by type Hull, is a voluntary type of contractThis is the main difference between CASCO and CTP. The owner, at his discretion, can use this service. The type of contract on a voluntary basis provides for compensation for damage to the owner of the car. In insurance cases of this type of contract, natural disasters, thefts of motor vehicles, traffic accidents, etc.

See also: How to challenge the penalty for parking in the wrong place

The name of this hull is not an abbreviation. This is only a Cyrillic transcription of the Spanish word "casco", translated as a headpiece "helmet".

When calculating the payment for registration of this policy, several indicators are taken. They include the brand of the car, its year of manufacture, the estimated cost of the vehicle, the driving experience of the owner of the car, the number of drivers who can drive this car, and several other factors.

Insurance payments can occur both taking into account the wear of the car, and without it. A similar clause is negotiated at the time of the conclusion of the contract.

Payments on this type of contract are carried out fairly regularly, without any special difficulties on the part of insurers. If there was any hitch, then you should immediately go to court. Such cases are almost always solved in favor of citizens, and not companies.

Difference between CASCO and OSAGO

Having a voluntary insurance policy does not cancel the purchase of compulsory insurance. CTP should be available when driving a car. Payment for hull insurance can vary from 1.5% of the cost of a car to 8%. However, the higher the cost, the greater the compensation you can expect when an insured event occurs.

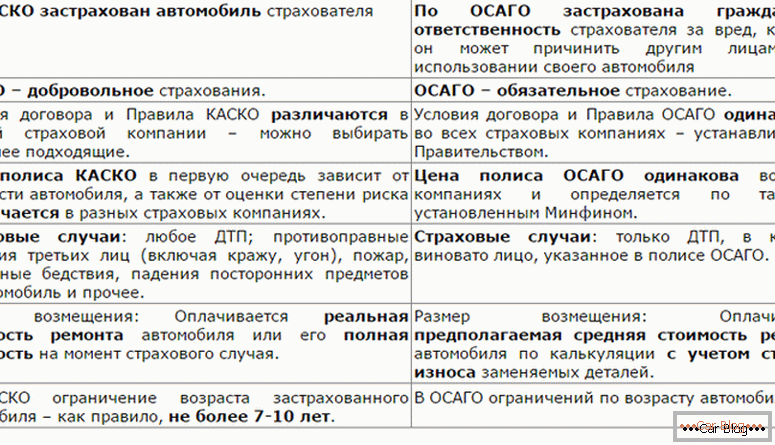

Comparative table of CASCO and CTP

As an additional service, companies when issuing CASCO often offer free legal advice or the possibility of evacuating cars from the scene. Sometimes a company may offer to use a rental car until your damaged vehicle is restored.

In compensation for hull insurance includes the cost of treatment of the policyholderif necessary. The CTP policy by law can only compensate for the damage you have caused, but no payments are made for the restoration of your vehicle by this agreement.

Insured Event Payments

Maximum possible reimbursement insurance policy is 400 thousand rubles, unlike the previous 160 thousand. A single refund cannot for this type exceed this amount. However, the number of indemnities under CTP is not limited to the contract. At the same time wear parts must be at least 50%previously there was a parameter at 80%. Now for parts that significantly affect safety, compensation is calculated without taking into account the coefficient of wear.

See also: Dates of inspection

Under the CASCO contract, the amount of payments is limited to the maximum specified in the contract. This means that if the document was drawn up, for example, for damage of 1 million rubles, and the cost of recovery after the first accident took 300 thousand rubles, then the remaining insurance claims, if they occur, can be calculated only from the remaining 700 thousand rubles.

Deadlines for reimbursement from the insurance company

Insurance companies must pay compensation for damages or send a vehicle for repair up to 20 business days, excluding weekends and holidays. It used to be 30 days. Beneficiary is granted five days after the insurer's decision to appeal the amount, if any. Only after the second appeal to insurers, a disgruntled client has the right to go to court to resolve the dispute.

The client can voluntarily give the insurance company an increase in the period for auto repair, if necessary. In this case, the entire responsibility for the obligation to repair the vehicle at the station lies with the insurance company, and the insurer will be at fault for the failure of the repair deadlines.