With the development of financial instruments, the possibilities of consumers of goods and services are expanding. After all, more recently, what is car leasing for individuals knew a limited number of people in our country, since the service was more popular with legal entities.

Frequently used were purchases on credit or rental vehicles. Each of these forms of car use has its advantages. Combining most of the positive qualities of both options is the leasing form of purchasing vehicles.

Content

- 1 What does leasing mean

- 2 Comparison of rent and leasing

- 3 Comparison of loan and leasing

- 4 Registration of the leasing contract

- 5 Who pays fines for traffic violations and other payments

- 6 Conclusion

What does leasing mean

During crediting, the citizen receives the requested amount from the bank and buys the chosen car or other property. In this case, such a citizen becomes the owner immediately, as the bank transfers the money to the account of the car dealer that provided the vehicle. After that, the owner repays the debt to the bank, using his property.

Under a lease agreement, a citizen is given a car or other property for use on a fee basis for a limited or unlimited period.

The property does not transfer the rental property, but the lessee is required to regularly pay the right to use the rental object. At the same time, no rights to ownership of a rented car or another object transferred for temporary use do not occur in any period.

When a car is leased to individuals, there are three sides to a deal:

- the lessor (the lessor-company providing the use of the car);

- the lessee (physical person, receiving cars);

- car sales company

The lessee communicates only with the lessor. Having chosen the right car, the citizen signs the contract, pays the initial fee and gets the car for use. Questions with the company-seller settles the lessor.

Comparison of lease and leasing

Lease use does not provide for additional initial fees when paying. Usually the same amount is calculated for all periods of use. A small cash deposit refundable upon termination of the lease may be used. Auto also transferred to the lessor. With this use, only the service is provided to the payer without transferring ownership.

Leasing Calculator Example

During the leasing relationship, the recipient of the vehicle pays the agreed down payment and signs a regular payment contract. Upon completion of all transfers, the car is reissued to the lessee.

The benefit of renting is obvious for short-term car use from several hours to several months.

In this case, you do not need to arrange insurance, take care of maintenance, you just need to refuel the car, and the company that owns the vehicle takes care of the rest.

See also: How to choose a car for a novice driverComparison of loan and leasing

Loan programs also have a large number of points similar to leasing programs. This is especially noticeable in the presence of down payment and repayment of payments. However, in the loan agreements the final cost of the car will be 7-15% more expensive. This also applies to new and used cars.

A large percentage of loan failures redirects the flow towards leasing programs. There, consumers do not consider the presence of other loan obligations, and the age of the client is not limited to retirement, as for auto loans.

Although, in contrast to Western countries, where cars are bought in such a way up to 30-40% of the total volume, and the Russians acquire only a little more than 2% of vehicles for natural persons, the sales dynamics still change in a positive direction.

Unlike credit conditions, leasing measures are softer, with smaller amounts of fines and additional payments.

Registration of the leasing contract

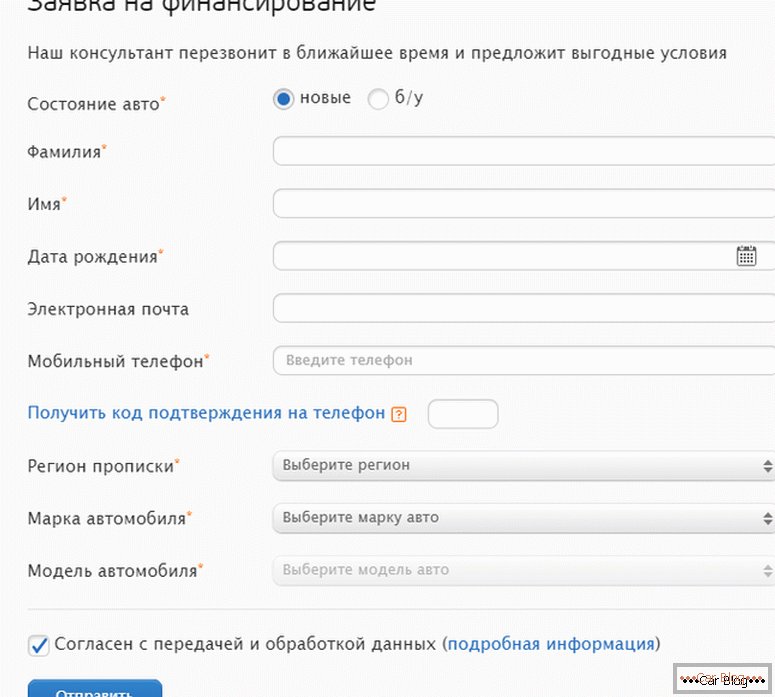

You can even find a company for a leasing contract on the Internet. In addition to the description of the preliminary conditions of the contract, on the pages of a virtual resource are calculators with the possibility of an approximate calculation of costs for this type of acquisition.

The standard set of documents for registration of the contract is:

- passport of a citizen of the Russian Federation (additionally, a foreign passport or a VU);

- completed questionnaire;

- confirmation of the source of income (employment record, rental agreement, etc.);

- documented amount of income (2 NDFL, act of receiving funds for the payment of rental housing, etc.).

This type of contract covers passenger cars of domestic or imported production in the amount of 300 000-6 000 000 rubles. The usual term for concluding an agreement is 12, 24 or 36 months. Six months after the paperwork, it is possible to early repay all payments.

Who pays fines for traffic violations and other payments

Standard leasing terms for individuals for a car imply possession of the vehicle of the lessor, therefore, photos with violations of traffic rules will be sent to the address of the owner. However, almost all contracts contain a clause on the priority of repayment of fines over regular payments.

See also: Checking the car for an accident on the Vin codeThis means that if a receipt arrived with a demand for payment, it will be repaid from the nearest client payment, but only the balance of the amount will go to a regular payment. Therefore, the tenant must control their fines and repayment amounts.

The transport tax is paid by the company-owner, but its amount is included in regular money transfers. Responsibility for registration of insurance contracts also lies with car owners, not tenants.

Conclusion

Like all operations in the financial market, leasing has advantages and disadvantages.

Positive:

- Simplified design compared with the loan.

- The form of using the car without re-registering it on itself, which helps not to include such property in the declaration

- Termination of the transaction is carried out faster and painlessly than under the loan agreement. Due to this, you can often change cars.

- In such companies you can get cars with real discounts from manufacturers.

- The cost of leasing is significantly lower than the rental of the same car.

Negative:

- Ownership is held by the lessor.

- The vehicle is limited in service locations specified in the contract, which is not always advantageous geographically or financially.

- When linking the cost of the car to the currency, the final price will be higher than originally planned.

- In contrast to the rent, you must pay an entrance fee of 10 to 49% depending on the company-seller

- The property is re-registered twice at the buyer's expense.

After weighing all the points for your case, you need to make a decision individually. But practice shows that the most profitable way is for premium cars and small commercial cars. In this case, you can often change cars, while the lessor company will deal with documentary issues.