The state seeks to redistribute incomes for various citizens. More affluent residents of the country according to this scheme pay a large amount to the budget when buying premium class goods. These products include luxury cars.

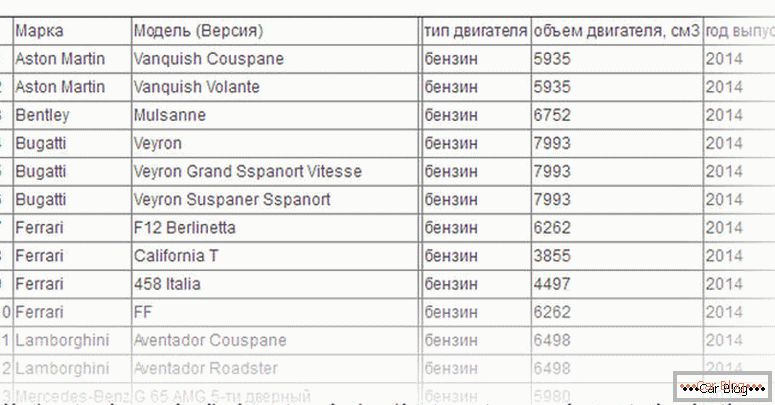

Under current law, when buying certain brands of cars, the car owner is obliged to pay a luxury tax on cars. There is a specific list approved annually for several classes of cars.

Content

- 1 Who pays

- 2 How to pay

- 3 Increase list

- 4 Minimizing costs

- 5 Interesting Facts

Who pays

The main evaluation characteristic is the cost of the machine and its model. The Russian Ministry of Industry and Trade including cars on the list is more price-oriented. It must exceed 3 million rubles for the model to become “luxurious” by the standards of the ministry.

It should be noted that the list of cars falling under the luxury tax in 2015 was 189 units, and in 2016 the figure increased to 280 units.

Such changes are planned annually. It is also allowed to exclude models from this list, but so far there have been no such precedents.

How to pay

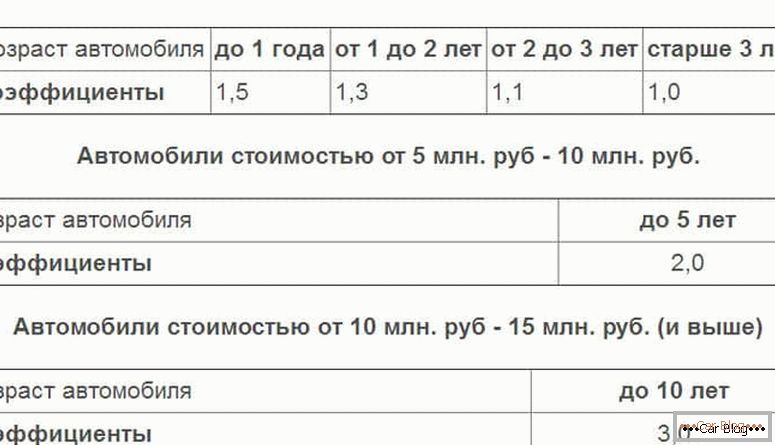

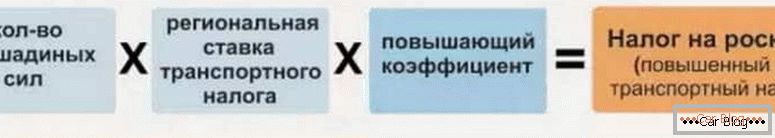

The law provides that if a car costs more than 3 million rubles, the owner must pay the amount calculated using a certain formula. The final payment also depends on the year of manufacture. For the calculation is used increasing the coefficient.

Luxury tax calculation - multiplying factors:

Increase list

The number of cars listed has increased by several dozen compared with previous years. Such an increase was due to the inflation jump. This means that cars that were recently valued at less than 3 million rubles have now been on the list of the ministry.

One of the first models that came to be in the premium price segment was the Mercedes E300. Now when buying a car owner is obliged to pay a luxury tax on cars. The hit was in this case solely due to the increase in exchange rate differences.

See also: Why the car eats a lot of gasolineAs an example, we give the calculation of the tax on this car for Moscow. Basic data are the volume of the power plant 3498 cm3, the release of 2015 and the price range of 3 million rubles. In the case of a normal calculation, the amount will be 18,759 rubles, and due to the increased coefficient of 1.5, in reality, it will be necessary to pay back 9 thousand rubles more.

You need to know that the transport tax is paid in the next calendar year after its accrual.

Accordingly, for 2015, car owners pay in 2016, and for 2016, payment is made in 2017.

Minimizing costs

Car owners can save on paying a luxury vehicle tax. This is done by re-registering the machine in a region with less basic parameters, because the tax itself also depends on the region of registration.

The age of a car for which the increased coefficient is charged also matters. The older the car, the less you will have to pay for it. A significant difference occurs after 3-5 years of operation.

The full list can be downloaded at the link: Luxury cars

There are also several categories of citizens for whom no incremental rate is applied. By criterion, ministries should not overpay such persons:

- disabled or retired;

- heroes of the social labor or the Soviet Union;

- owners of three or more dependents;

- citizens who have the Order of Glory or the Order of Lenin.

You can get into the categories yourself in any way, or you can re-register a car for a ready-made pensioner or order bearer.

Interesting Facts

The updated lists did not include such cars as Maybach or Porsche Cayman. Probably the crux of the matter is that the basic equipment has not yet reached the cherished figure of three million rubles. However, it is hardly possible to find these cars somewhere in the country exclusively in the basic set. Even the legendary Toyota Land Cruiser 200 did not reach to the list.

See also: How much is the most expensive car in the worldA positive solution could be to reduce the tax for hybrid cars. After all, most of them have a high cost. Minimizing the tax for such machines would benefit the country's ecology.