Практически каждый владелец транспортного средства в России знает, что ему в обязательном порядке необходимо вносить различные платежи в казну, в том числе транспортный налог за автомобиль. Однако не все знакомы с рассматриваемым видом выплат, не знают, как calculate transport tax и как его перечислять. Особенно остро эта проблема стоит для людей, которые совершенно недавно приобрели свой первый транспорт. Для них будет полезно получить ответы на возникающие вопросы, а также полную информацию о транспортном сборе на машины в России.

Content

- 1 Who pays transport tax

- 2 Calculation of tax on transport

- 3 All sorts of discounts and benefits

- 4 Car tax payment

Who pays transport tax

For the correct calculation of the tax on transport you need to specify the tax rate for your region.

The tax code of the Russian Federation determines the general procedure for civil taxation, the list of persons who are to pay it in due time, as well as the amount of base rates. It is on the basis of the rates that the direct amount of payments for different regions is determined. The remaining functions are handled by local authorities. It often happens that the rates set by regional authorities differ from base ones by eight times.

Territorial authorities have the right to make additions to the procedure of taxation, to establish various benefits for certain categories of persons, the timing of payment of the fee for transport and so on.

Transport tax has its own characteristics. For example, payments must be made not by the person who uses the car, but by the person to whom the vehicle is registered. Sometimes it turns out that the owner sells the car to another citizen on the basis of a general power of attorney, and after a while receives a notice about the need to pay tax on a car that is no longer there. This is a significant legislative flaw. Following the logic, the vehicle must be paid by the person who uses it, and not the person to whom it is registered. The authorities are actively trying to eliminate the resulting problem. However, at the moment it is still taking place.

See also: Passing the medical board for the rights: what you needCalculation of tax on transport

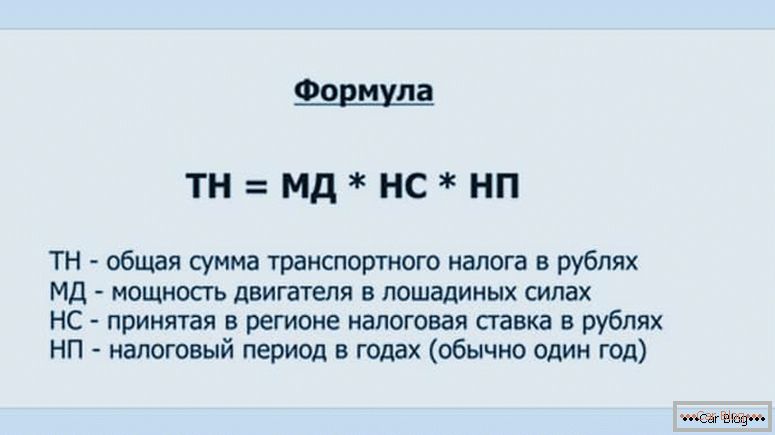

The calculation of the transport tax is determined on the basis of the so-called tax base, which establishes the direct amount of payments. Characteristics of the car are the tax base of the transport fee. In the Russian Federation, the base is calculated based on engine power, which is calculated in horsepower. Manufacturers of some cars indicate power in kilowatts. To convert the units in question into horsepower, it’s just worth knowing that one kilowatt equals 1.359 l. with. It is important to note that the year of release of the car does not play any role on the collection rate. For calculations, you need to multiply the amount of horsepower by the indicated tax rate.

This formula will allow to carry out calculations correctly and establish individual indicators for each vehicle owner.

Formula for calculating transport tax

Take for example the car Hyundai Solaris, which has a capacity of 123 horsepower. The main goal is to correctly calculate the tax amount. For calculations it is necessary to apply a special formula:

Tax rate x engine power x total time of owning a car. As a result, we obtain: 3.5 rubles x 123 horsepower x 8 months = 287 rubles.

It is important to bear in mind that 3.5 is the single average rate of the Russian Federation.

Note: regional authorities can increase or decrease the tax rate on horsepower, but not more than 10 times, so you need to specify this indicator for your subject of the Russian Federation.

Individuals do not need to personally carry out calculations of car tax, since this procedure is the responsibility of the tax authorities in the region. Each year, tax organizations are required to send notices to the vehicle owner indicating the amount of payment.

Nevertheless, calculations made by the tax service for car owners should be checked. Often, the tax service may make ridiculous mistakes and blunders in the documents sent. There are also situations where the owners receive not only notices for the payment of the fee itself, but also penalties for late payment. Such problems arise because the notice was sent to the destination, and the owner of the car did not receive it. It makes no sense to dispute, so you have to make the required payment.

See also: Sample of filling out the accident noticeAll sorts of discounts and benefits

More often, veterans of the Second World War, heroes of the USSR, disabled people, etc. can receive benefits.

All regions have the full right to independently introduce discounts and benefits to pay car taxes for certain categories of citizens. Basically, these advantages have the participants of the Great Patriotic War, the heroes of the Soviet Union, the disabled, who received the first or second group, the owners of cars with small engine power, cars of power structures. You can get detailed information about preferential taxation at the nearest tax office.

Car tax payment

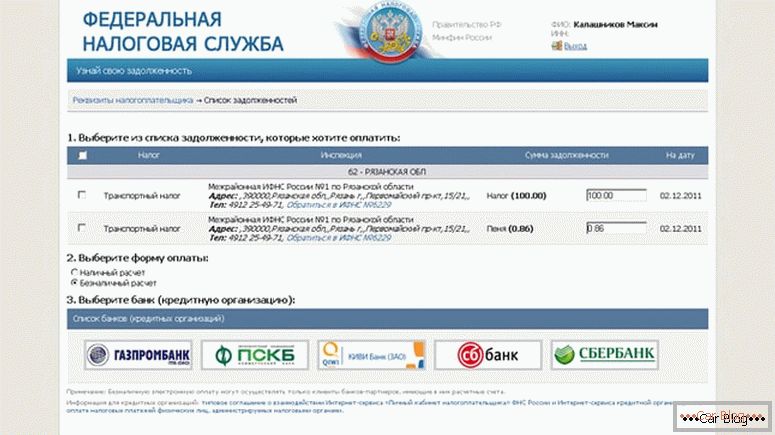

The question: “How to pay transport tax?” Is also very relevant for every car owner. Before direct payment, you need to clarify the full-fledged debt in the tax authority, where each owner will be provided with full information of interest.

You can find out the amount of debt and make payment via the Internet

Tax payment can be done in various ways:

- Payment in a banking institution where a notification will be required.

- Through a special electronic wallet QiWi.

- With the help of Internet banking services.

The transport tax is in its essence considered to be a regional fee, where the size and order of payments can be set and changed by local authorities. This type of tax, depending on the power and class of the car, is obligatory for every transport owner. It is important to point out that the year of production of motor vehicles does not affect the total tax amount. Absolutely all taxes must be paid on time. This approach will subsequently help to avoid additional unnecessary expenses for late payments. Paying taxes on time, you can sleep easy!