According to the legislation of the Russian Federation, civil liability is expressed in the obligation to compensate for the damage caused to the injured party. On this basis, third-party liability can be defined as compensation for damage caused to property and human health on the road. Simply put, if you have damaged someone else’s car or touched a pedestrian, you are obliged to pay expenses directly related to the restoration of the car and the treatment of the person.

Not so long ago, the perpetrator of the accident, as well as the victim were forced to independently deal with the consequences of what happened. At the same time, conflicts were inevitable, since each of the parties in its own way understood the guilt and size of the harm, as well as the amount of compensation. And if the guilty party still did not have sufficient finances to cover the expenses of the victim at once, then it was doubly difficult to find a compromise.

Since 2003, the situation has changed. Since July 1, the law “On Compulsory Insurance of Civil Liability of Vehicle Owners”, the state has clearly defined what Compulsory Insurance is Civil Insurance or CTP. This simplified the conflict resolution process - now the insurance company pays for the restoration of the car and the health of the victim. The main condition is that the owner of the car should have a valid CTP insurance policy.

Content

- 1 What documents are needed?

- 2 And what about the timing?

- 3 Issue price

What documents are needed?

Due to the emergence of CTP, drivers no longer need to pay damages out of pocket in the event of an accident.

To apply for a policy, you should contact the insurance company, having prepared the following documents for the OSAGO:

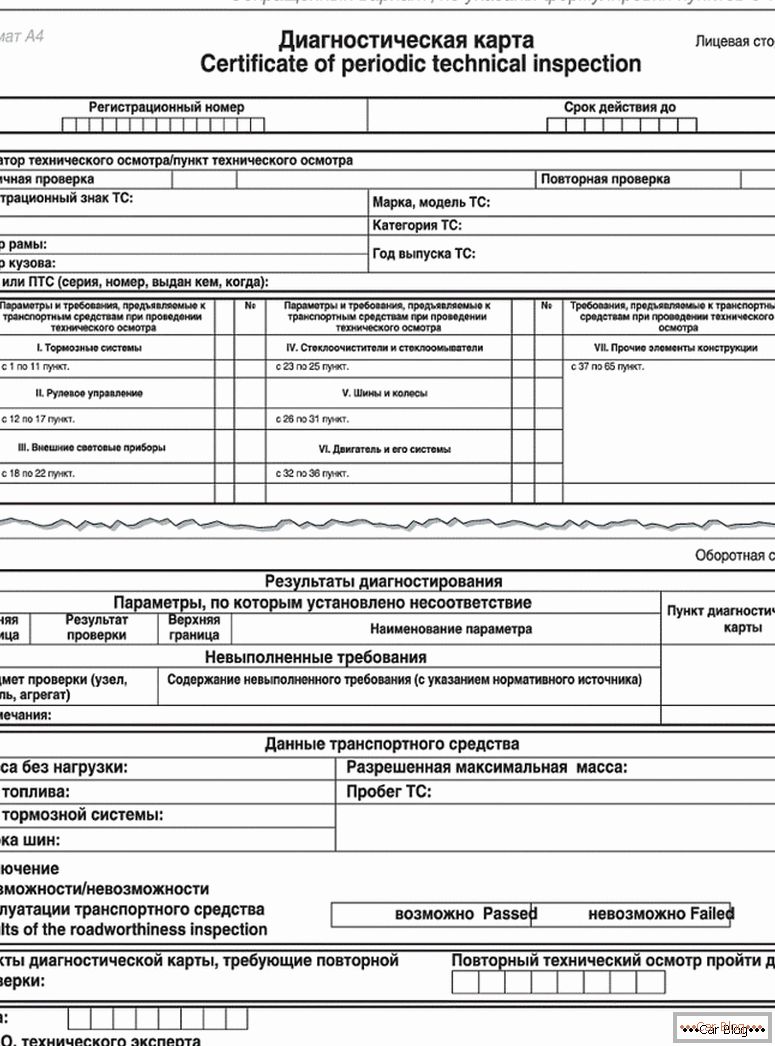

- Vehicle inspection. It is confirmed by a diagnostic card, which can be obtained after passing a vehicle inspection by experts at a service station (HUNDRED), with which your chosen insurance company cooperates. However, the insurer should not force the insured to undergo maintenance in a particular company. This entails the imposition on him of an administrative fine of 50,000 rubles.

- Passport of a citizen of the Russian Federation or another document that certifies the identity of the future policyholder. If the insured does not own the insured vehicle, then the owner's passport will also be required.

- Driver's license. If several people are included in the insurance, who will be given the right to drive a car, then they will require a driver's license from all of them. It is possible to issue an insurance policy without restrictions of a circle of persons, then only the rights of the insured will be needed, but such a policy will be more expensive.

- Power of Attorney to drive a vehicle. Its presence is necessary when the role of the insured is a person who is not its owner.

- Technical passport of the car, in which the owner of the car and the technical characteristics of the insured vehicle are registered, the year of its release.

CTP policy can not be issued without a diagnostic card inspection

Данные documents for registration of OSAGO предъявляются представителю страховой компании строго в оригиналах для возможности установления их истинной подлинности!

See also: How to check the fines for a driver's license onlineAnd what about the timing?

The contract between the insurer and the insurer is made for a period of one year, however, you can choose the period of validity of the insurance at your discretion based on the time of use of the car. For example, you operate your car only in the summer-autumn season - from June to November inclusive. In this case, it makes no sense to pay annual insurance, you can pay only 6 months. But if the accident happens outside the paid period, the insurance company will refuse to pay damages to the victim, and you will have to pay him out of his own pocket.

Issue price

The price of the CTP policy depends on the power of the vehicle, its service life, driving experience, etc.

You need to pay for any service, which means that the question of how much an OSAGO costs is especially concerned for vehicle owners. Their size depends only on the brand of transport, its service life, power and engine size, body type, type of gearbox (mechanic or automatic), driving experience and driver’s age.

The basic tariff for compulsory motor TPL insurance is set by the Bank of Russia and today, taking into account the changes of the end of 2014, for individuals who own cars are 2,440 rubles.

In addition, when calculating the value of OSAGO, the region in which the car is insured is also taken into account. To do this, the calculation of CTP uses a regional factor. The thing is that there is such a thing as an accident rate of a territory. In some regions of Russia, its figures are higher, in others - lower. Accordingly, somewhere insurance payments are made more, and companies are more unprofitable, and somewhere vice versa. So, in the first case, auto insurance will cost more than the second. For example, in the Arkhangelsk region, it will be necessary to pay for the CTP insurance policy more than in St. Petersburg, because in the Northern capital the insurers' loss ratio is twice as low as in Arkhangelsk and is about 40%.

See also: Road sign entry prohibitedAlso, when calculating the size of the insurance policy, you will always be asked if your accident has caused accidents in the past. If insurance claims occurred and you were found guilty, then you will be applied an increased coefficient of insurance tariffs, and vice versa. The absence of accidents due to your carelessness will allow the insurer to apply the system of discounts, which in professional language is called “bonus-malus”. For those who carefully behaves on the road, this system allows significant savings on compulsory auto insurance.