MTPL policy It is one of the three mandatory documents that the driver must always carry with him when driving. This requirement is particularly relevant when the insured event.

What information should be included in the contract on compulsory insurance of civil liability? This document implies the mandatory filling out of the name and all necessary information on the respective vehicle.

The next logical question is whether they can delay and evacuate a car if the driver did not have a CTP insurance policy on him during the ride. No, they can not. Such a measure is not provided. However, it is necessary to pay a fine for driving a vehicle without a corresponding document. Law is law.

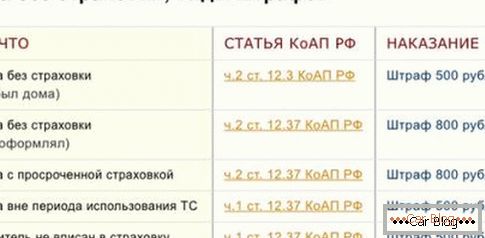

It is worth noting that since January 1, 2018 the amount of the fine for the absence of an OSAGO contract for drivers remained unchanged. And depending on the circumstances, for such an offense will have to pay from 500 to 800 rubles. What is the reason for this and what does the size of the fine depend on?

Forgot your home insurance policy?

One of the most common and harmless situations - the driver forgets his CTP policy at home. In this case, sometimes you can get rid of a simple warning from the traffic police inspector or get a fine of 500 rubles. If you are in such a situation, you can call home and ask relatives or friends to bring the missing documents.

See also: In the new 2018, the new regulations of the Ministry of Internal Affairs of Russia came into force: “On the Transport of Dangerous Goods”Since the forgotten home OSAGO is still listed in the database, the inspector can go forward and wait for the forgotten home insurance. Also, 500 rubles of a fine can be issued both for an expired policy, and for the fact that another driver is indicated in the contract, or another car. Some drivers mistakenly believe that the law provides for the possibility of driving with expired insurance for a month with impunity.

Please note that this is not the case. The duty of the driver in a timely manner to ensure that all documents were in order. It should be remembered that after the registration of the vehicle is given exactly ten days to get a CTP policy. And if during this period you are stopped by a car inspector, and the insurance has not yet been made, then you must have a certificate of car registration with you. By submitting it, you can avoid an undesirable penalty.

OSAGO to help

If the driver does not have an OSAGO policy at all, this situation is considered by car inspectors as a more serious violation. And the size of the fine immediately increases to 800 rubles. One may argue that it is more profitable for drivers to buy a CTP policy or to pay a penalty for his absence.

However, it is extremely unreasonable to refuse insurance and put yourself at risk of reparation from your own pocket in the event of an accident. After all, even experienced drivers are often the culprits of accidents. And if we take into account that the maximum payments on the CTP insurance policy have significantly increased and can reach about 400 thousand rubles, that even a minor scratch on a car can cover the full cost of insurance, the answer is obvious.

See also: Citroen C4 is a completely new model