Russia does not cease to introduce various innovations relating to its tax reform. Transport tax - this is its next stage, held in the country. Previously, there was a road tax and a tax on vehicle owners. Now it is determined by one term transport tax.

Content

- 1 Administration subtleties

- 2 How to check the tax on the car, so as not to disturb the period of its payment

- 3 How to check transport tax on your fines online

- 4 Learn about the state number debt

- 5 How to determine transport tax arrears by last name

Administration subtleties

In addition to the terminology, there is a legal difference between the regulations. Road tax was paid by legal entities, and transport tax applies to all vehicle owners. It is charged, for a specific car, with the owner of the same car. In the budget, the transfer is made from the owner of any registered vehicle from the passenger car to the tracked vehicle. Payable transport tax:

- Cars;

- self-propelled vehicles;

- motorcycles, scooters and scooters;

- aviation;

- water transport;

- snowmobiles

Exceptions when paying transport tax:

- if a person has a disability of 1-2 groups and the car was obtained thanks to the social fund (the volume of the engine is taken into account, not exceeding 100 hp);

- The owners of motor boats are exempt from paying tax, the motor power is not more than 5 liters. with.;

- transport for agricultural services;

- cars in the hijacking with the provision of supporting documents;

- federal agencies were released, on the balance of which, military vehicles are listed;

- participants of the Chernobyl NPP;

- veterans of the Great Patriotic War.

It is possible to familiarize with the full list in the Tax code of the Russian Federation as it can be corrected further.

Payment applies to every motorist, except for the preferential category of citizens. Each car owner must pay the set amount, regardless of financial condition, region of residence, or position occupied in society.

As an exception to the rule, the transport tax may not be paid on the territory of the Russian Federation in three regions:

- transportation fee is not charged from the machines, the volume of which up to 100 liters. with. in the Orenburg region;

- owners of such cars are released, the volume does not exceed 150 liters. with. in the Nenets Autonomous District;

- no fee is charged for cars whose wear has not exceeded 10 years and with a capacity of up to 100 liters. with. in Kabardino-Balkaria.

How to check the tax on the car, so as not to disturb the period of its payment

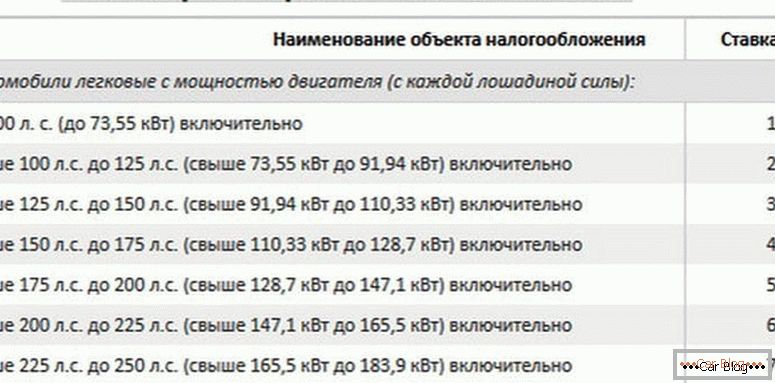

It is important to understand that the value of this tax differs from territorial location, as well as from the own characteristics of the transport itself. This type of tax is one of the main niches occupied in the road sector. In order not to be included in the list of unfavorable taxpayers, the tax service sends annually mandatory payments.

For example, a motor vehicle owner’s vehicle tax for 2016 must be paid no later than October 1, 2017. The notification is sent by the inspector a month before the payment. The notice provides information about the amount of the toll for the previous period.

There are several actual options for how to find out transport tax arrears. We list them:

- to appear independently at the place of his registration with the tax inspectorate;

- call your regional inspector;

- send a written application requesting information on the transport tax;

- wait for a receipt drawn up by a specialist.

Passive waiting for a document is not always a winning behavior, as the document may not come. And this may be accompanied by a number of reasons:

- the driver does not own the car;

- the address of registration has changed, but the tax data has not been received about this;

- the letter is lost at any stage of its transmission to the addressee;

- the traffic police authority did not transfer the information to the tax authority;

- the owner of the car did not inform the tax inspectorate about registration with the traffic police;

- calculations revealed violations that require some time to be corrected.

How to check transport tax on your fines online

This is the most convenient way to accept information. One of the advantages is that it is free. More recently, we could get information about fines only from the traffic police, by calling or a personal trip to the police station. And they could have been recorded somewhat in different places, then they had to beat the thresholds of all the listed units. As a rule, many refused to exhaust themselves in this way and simply waited for notice from bailiffs.

Introducing the main online portals for review:

- Through official online services, such as the official website of Gosuslug. To use this resource will have to go through simple registration. Data is entered on the location on which the set of services depends, the initials of the car owner, cell phone number and current e-mail. After the user must log in. This will take a certain amount of time (applications are reviewed up to two weeks). However, all the information on your tax debts will open, compensating for the expense of lost time.

- On the official website of the FSSP. Here you will see a picture of the debt amounts sent by the court to the federal bailiff service. You must enter all the requested data of the car and the coordinates of the owner. Once on this site, you can see that there is an entry function through the portal "Gosuslugi". The FSSP website also provides information through the social sites Vkontakte and Odnoklassniki, through the application “Databank of enforcement proceedings”. After registration procedures, will reveal all about the transport tax. The ability to print the necessary information is available.

- On the website of the Federal Tax Service (Federal Tax Service). This is the All-Russian debt control portal for citizens and legal entities. To start using, the visitor must undergo mandatory standard registration. As a result, he will have his own virtual account. Login coincides with the taxpayer identification number. It remains to come up with a unique password. Having already entered your page, choose the section “Overpayment. Debt". This will open all the complete tax history, including transport tax. The right to repay debt in several ways. With one click, the system will pay and print a confirmation receipt.

- Receiving a letter of notification by mail. The tax independently issues a payment document and sends it to e-mail recipients.

- It is convenient to receive regular information about any changes or the presence or absence of debt through mobile applications and subscribe to their newsletter.

How on the presented online resources, the user has the opportunity to request information about the debt? This can be done in the following ways:

- find out vehicle tax liabilities by car number;

- under the driver's license;

- by registration certificate number;

- by resolution number;

- find out the tax on the car by the name of the owner;

- by tax identification number.

Learn about the state number debt

Find out the vehicle tax by car number will not work on any of the portals, except the FTS. Hoping to find out the amount of payment of the transport fee, other coordinates will be required:

- number of the payment document;

- insurance number of an individual personal account;

- TIN - taxpayer identification number;

- initials possible tax offender.

Important! If you are the owner of several vehicles, according to the registration number of the car, you can determine which of the cars came under the tax.

You can see it in the following ways:

- In the notice of the tax. If you are personally handed this notice, in which you signed, the debt amount by car number can be found in the form.

- In the personal account of the FTS website. Only by gaining access to your own office, it is possible to find out whether a tax has been charged or not. However, the account is available to users who received a login and password in the tax authority. To do this, contact your nearest tax office. This may not necessarily happen at the place of residence. You will need a passport, identity card, identification code, power of attorney, necessarily notarized if it is the person you entrusted and a statement of the established sample.

There is no other way, since this is a tax secret. After one month, the password must be changed. If you carelessly forgot about the timing of a password change, get ready to visit the tax office again for another connection. This is a necessary security measure, since the password is initially issued on a paper sheet.

Without visiting the tax structure, the only way to find out about the debts will be only the presence of an electronic signature or an electronic card. On the main page, enter the contact phone number and email address. The remaining information pulls on its own.

It is possible to look at which of the transports of the road toll according to the registration number of the car, possibly in the “Personal account” of the taxpayer in the “Objects of taxation” paragraph. It displays full information on all tax amounts, including the transport tax.

How to determine transport tax arrears by last name

We note that this method makes it possible to find out information only on the website of the bailiff service. Registration is not required. The “by last name” method will be effective only when the amount of arrears has increased to an impressive size and the case has been filed by the fiscal service in court. There, in turn, the judge decided in favor of the applicant.

The process does not take much time. You will need to open a list of data on the enforcement proceedings. In a certain field, the initials and the address of the tax offender are entered, as a result we get the amount of debt that the experts counted.

It is important to know that this online service provides information only on overdue amounts of debt that are transferred to the bailiffs for enforcement.

If you find the desired data on their own vehicles in the registry, it is necessary to hurry with the payment of the amount of debt. Otherwise, the car owner is threatened with financial and administrative sanctions:

- tax inspector visit;

- withholding debt from wages until full repayment;

- accrual of interest;

- Seizure of all types of bank accounts;

- confiscation of the valuable property of a malicious defaulter;

- when a certain debt is reached, a ban is imposed on leaving the country’s borders.

If the owner of the vehicle does not agree with the billing requirements, he has the full right to appeal in court. The procedure is carried out on the basis of certain documents:

- Driving license. It is appropriate if there are several own cars in the garage.

- According to the registration number of the vehicle. The technique takes place if one car drives several people. The driver can be anyone: wife, children, personal driver. Information about the amounts of the fine can be obtained for each driver.

- By order number. It is easy to guess that this method is suitable for those who received a notice of administrative offense.

It should be borne in mind that the base of penal violations itself is huge, and it takes some time to search for a fine. If there are no fines after the current virtual check, this does not mean that they are absent at all. The system may crash and fail to identify your fine for any technical reasons. Such situations are extremely rare.

Одним из самых распространенных методов поиска штрафов, не обязательно даже транспортного налога, это поиск by tax identification number. Проверять суммы долга можно с помощью таких сервисов:

- own office of the Federal Tax Service;

- the official website of the portal "State Services";

- Sberbank Online;

- also with the help of electronic wallets: Yandex.Money, WebMoney, Qiwi.

Payments are recommended to be paid on time, especially since this stimulates the law “On paying tax with a 50% discount”, adopted in January 2016. According to him, if you make the amount of the violation written out within twenty days, the payment of an administrative fine is possible with a 50% discount.