The modern insurance market is regularly filled with new products. An important place in it is given to products associated with road transport. Recently, more and more drivers are interested in what a franchise is in the hull and how it works. Unfortunately, not all agents are able to independently explain the essence of this phenomenon and the possible benefits for the client.

It is appropriate to remember about the safety of the machine in advance, therefore, on time and properly concluded contract for hull insurance will leave the signatory in profit even with a possible theft or accident. Car owners sometimes manage to knock down the price of a policy by 15–70%. With its considerable cost, these figures are able to interest many thrifty Russians.

Content

- 1 General concepts

- 2 Available types of franchises

- 2.1 Conditional Type

- 2.2 Unconditional franchise in insurance, what does this mean?

- 2.3 Temporary type

- 3 Dynamic type

- 4 Positive and negative insurance methods with franchise discounts

- 5 Benefit from CASCO with franchise

General concepts

It is believed that the interpretation of the concept of a franchise is more relevant for people associated with business activities. In their case, you can get some type of benefits or a set of certain services in the form of a bonus.

Однако, автолюбителям важно понимать, What is a car insurance deductible?. Для сферы транспорта суть явления заключается в определении степени участия владельца ТС в возможных рисках, которые первоначально берет на себя страховая организация.

It is important to understand that the insurance deductible (which is “simple” words) is defined as part of the damage that the owner of the car covers at his own expense in case of an insured event.

Financial preferences translate into a comfortable discount for the purchase of a CASCO policy. The final amount of the discount depends on the level of risk that the owner of the car voluntarily puts on his shoulders.

Parameters of distributed liabilities between the signatory parties are recorded in writing. They can be expressed as a fixed amount or set as a percentage. Traditionally, most contracts include deductible values at the level of 10% of the potential reimbursement.

For example, when the established amount of damage reaches 90 thousand rubles, the citizen in the form of compensation with a 10 percent discount will receive only 81 thousand rubles. This illustration clearly demonstrates the work of the franchise. In each case, you have to understand personally.

Available types of franchises

A limited number of types of franchising are used in our country during the execution of a CASCO policy. In each situation, there are individual characteristics. The user can independently choose a suitable option in the company.

Conditional type

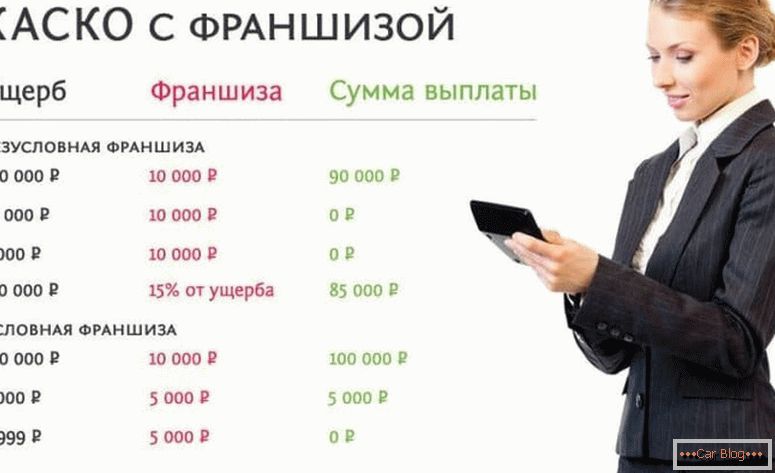

A conditional deductible in insurance is a case in which a fixed financial threshold is defined, below which the car owner independently restores the vehicle without the participation of insurance companies. When the estimated amount is higher than the previously agreed limit, then payment of expenses is fully borne by insurers.

It is important to note that in the conditional type of the contract, if the threshold value of a fixed amount is exceeded, the owner of the car does not take part in the repair, and the expense is borne solely by the insurance company.

An example would be the case when the contract specifies the amount of the limit of 20,000 rubles. If the car is damaged by 15 thousand rubles, then the driver must repair everything himself. When the examination determines the damage, for example, twice as big, then the company will fully contribute that amount.

See also: Fine for speedingAlthough this technique is very beneficial to the two signatories of the contract, but in practical terms it is quite rare. The technique leaves a great chance that the scheme can take advantage of fraudsters. Artificial overvaluation of damage will be in the hands of dishonest citizens. In this regard, not all agents are in a hurry to include this type of cooperation with customers in their list.

Unconditional franchise in insurance, what does this mean?

The peculiarity of such a contractual relationship between the client and the insurance company is the mandatory financial inclusion of the car owner in the resuscitation of the car. The level of immersion of citizens can also be expressed as a percentage or fixed.

An example is the case when there are confirmed damages in 4 thousand. Then there are two options:

- if the amount of the unconditional transaction is set at 4 thousand or more, then it is made exclusively by the owner;

- if the amount of the unconditional franchise was set lower, then the surplus is paid to the legal entity, and the owner of the car makes only the fixed payment specified in the contract.

The signed agreement, in which unconditional responsibility is defined as a percentage, is calculated somewhat differently. Reimbursement is made in proportion to each of the parties. With a 20% share for the car owner, the balance of participation in the repair will be as follows:

- for large sums, for example, 30 thousand losses from the owner will require only 3 thousand rubles, and the remainder of the sum is paid by the CASCO signatory from the other side;

- minor damage is divided by the same parity ratio, for example, damage of 5,000 rubles. will require the payment of half a thousand from the owner of the car, and the balance is repaid by insurance companies.

The amount of payout in such a situation does not matter.

Temporary type

In simple terms, a franchise in auto insurance of this type means the extension of a contract for a pre-agreed time interval. This helps to significantly save money to citizens.

An example is the possibility of determining the period only weekdays. On weekends, such insurance may not apply, because the owner can use vehicles exclusively for business purposes.

The cost of such a policy will be lower than under normal conditions. However, it is worth knowing that the damage received during the insurance period will not be paid. In addition to this method of use (division into weekdays and weekends), insurance agents may offer products with differentiation according to seasonality or another type of clear time gradation.

Dynamic type

Drivers who have considerable confidence in their abilities will be able to use a dynamic type of contract. It is based on the previous insurance history of the owner of the vehicle, which includes all possible payments on hull insurance and their number. At the same time, the signatory receives the largest amount of compensation for the first insured event, and in subsequent episodes a regressive scale is applied to the payable amounts.

In fact, for each subsequent appeal from the car owner, the insurance company will set a stepwise reduction factor. Most often, this rate is fixed at 5% for each insured event.

See also: What documents are needed for OSAGOIn addition to the listed common contract options, with insurance companies in case of concluding a CASCO, other options for cooperation with mutually beneficial discounts can be applied. In the Russian realities, the unconditional type of franchise is most often encountered.

Positive and negative insurance methods with franchise discounts

It is important to the user before the application of the finished product to evaluate its disadvantages and pros. As in other cases, autofranchising has both qualities during real use. The advantages include factors:

- Significant reduction in the price tag for the policy. The discount is directly proportional to the size of the established franchise. The increased participation of the car owner in the risks reduces the cost of insurance.

- There is no need to contact the insurance company for fixing insurance claims at the time of occurrence of damage with a small amount of calculated damage. The amount of compensation, as a rule, does not always justify the effort spent on fixing.

- When a limited bar is installed, the car does not appear in the negative insurance history, allowing it to remain legally clean.

The disadvantages are such situations:

- There are difficulties in processing such contracts with credit machines. Traditionally, the cost of insurance is borne by the borrower, in this regard, for the lender is not a discount priority. However, the credit company has its own interest in keeping the value of the collateral property. There are also no guarantees in the restoration of the machine at its own expense by the borrower. These theses are forcing credit and banking organizations not to use the contract with the franchise.

- There is a danger at which there can be an artificial reduction in the amount of damage. Some experts are inclined for various reasons to the side of insurance companies, not allowing the amount of damage to rise above the established limit under the contract.

Benefit from CASCO with franchise

The advantages of insurers in such contracts are obvious. They are legally exempt from the majority of small payments to citizens, which saves resources. It is important to understand that often a large amount of time and money is lost in processing such trifles, which turns out to be incomparable with compensation.

For the owner, this kind of cooperation with the UK can conceal less benefit. During the evaluation of the feasibility of insurance with such a method, it is necessary to take into account your own driving experience, the goal of concluding a contract, the frequency of vehicle operation and individual conditions on the part of the company.

To recommend such an agreement is in such cases:

- The driver has a great trouble-free driving experience. In this situation, the probability of an accident is extremely small. Most companies are interested in such customers and therefore strive to keep them with different discount programs.

- If the basic purpose of a CASCO purchase is to protect against theft, then this type of policy will be the most acceptable for the car owner.

- When the amount of discounts on the purchase of the hull exceeds the size of the franchise itself.

- The driver can have a sufficient amount of funds to resolve minor faults on their own.

- The car owner is interested in extending trouble-free experience. Small incidents can negatively affect the price of future insurance and reduce the estimated coefficient.

For drivers with little experience, such conditions are not always relevant. This is due to the more frequent hit in the accident with a small driving experience.